Brief Background:

Prima Plastics started in 1993 manufactures plastic moulded furniture (PMF). The company manufactures products ranging from chairs, baby chairs, dining tables, stools, teapoys, material handling products etc and competes with the likes of Nilkamal, Wimplast, etc. PPL is the third largest player in the plastic furniture segment after Nilkamal and Wim Plast with a value market share of ~6%.

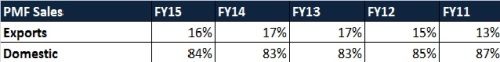

The company has a presence across India with manufacturing plants in Daman and Kerala. PPL sells its products in the northern and eastern markets through the outsourcing model.The company has 200 distributors and a dealer network of over 2000 across India. PPL exports its products mainly to Africa, Middle East and Latin American countries.

To tap African markets, the company formed a 50% JV with Deelite Global in 2006 called Prima Deelite Plastics Pvt Ltd in Cameroon.Prima Deelite Manufactures the same PMF and HDPE woven sack Bags.

To be Noted:

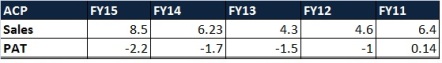

Till recently the management’s attention was divided between profitable PMF business and loss making ACP(Aluminium Composite Panels) business. With the closure of ACP business in Jan’15, PMF will have undivided attention and further the company can use the existing location, facilities for expansion of PMF manufacturing and focus on expansion of distribution network.ACP Buisness line contributed 7% of overall sales and had been consistently reporting losses since FY12 as you see here:

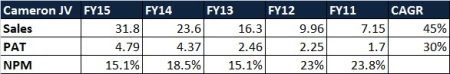

The JV of Prima Plastics in Cameroon has been performing extremely well. Prior to setting up a JV, the company had been exporting to Cameroon and later on realizing the potential and limited competition decided to set up a JV for manufacturing in Cameroon itself. In the last 5 years, Prima’s share of revenue (50%) in JV has grown from 7.15 crores to 31.8 crores and the Profit after Tax has grown from 1.7 crores to 4.79 crores. In fact, JV is reporting higher profitability than the domestic operations of Prima Plastics.In order to maintain the growth rate the JV also recently embarked on USD 1 million expansion plan funded entirely through internal accruals.

Lastly, on the back of success in Cameroon and experience of exporting to other African and Central American nations, Prima plastics is exploring the opportunity of setting up manufacturing units in small Central American and African countries and zeroed in on Nicaragua in Jul’15.

Management:

Prima Plastics is led by Parekh family with Mr. Bhaskar Parekh(Age:57) as the Executive Chairman and his brother Mr. Dilip Parekh(Age:46) as the Managing Director. The promoters own reasonably good 58.85% stake in the company and thereby their interests are directly aligned with those of minority shareholders.The management has not diluted equity in the last 10 years and has managed to grow the business through internal accruals and debt. In fact, on consolidated basis the company is debt free with surplus cash of 3-4 crores.

Further, sooner than later management has closed the non-profitable ACP unit to focus only on its core competency of PMF business.Management has remained conservative and have been forthcoming in accepting mistakes(Closure of ACP) and has not taken any extreme risk for growth or expansion.Overall, company’s disclosures policies, remuneration to the promoters and related party transactions are within reasonable range and we haven’t found any major issues in terms of corporate governance.

Numbers Talk:

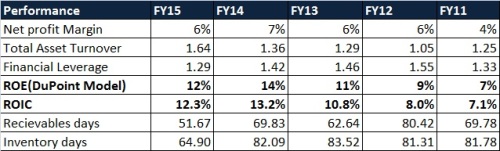

The company’s reported performance over the years has been reasonable but could have been much better; however ACP division consistently reported losses and impacted the performance of the company to a certain extent.Focusing only on PMF business, the company has reported around 15% CAGR in sales over the last 5 years and ~16% CAGR in PBT over the same period.

Company has been paying Dividends and taxes regulary.Cashflow also has been positive for the company.There has been slight improvement in the margins and efficiency over the years . This is despite the losses of ACP Buisness and now PMF business being the only point of focus, Company should be able to touch double-digit margins taking the ROE to 20% during the coming years.Margins have already improved in the First half of FY16 partially due to Commodity slow down and improving efficiency.

JV in Cameroon has been reporting extremely good performance in terms of growth (though on a lower base) and profitability and is expected to continue performing well on the back of relatively low competition and growing demand in the country and nearby African countries.Exports have contributed 16-17% of the sales in last few years and 1Million expansion in Africa JV and manufacturing plant to be set up in Nicaragua for Latin America could be the growth drivers in the coming years.

In the domestic market, the company plans to enter Andhra Pradesh by establishing a manufacturing plant near Vishakhapatnam. This will help the company to increase its market share in the eastern region.

Positives:

- Strong Balance sheet with D/E at 0.06.

- Closing of ACP buisness speaks good of the management and this will lead to better profitability and return metrics

- Improving profile of business on the back of better revenue mix in favour of JV and export sales sounds good.

- Negligible Institutional holding at 0.01%

- Highly Illiquid.

Risks & concerns:

- In case of huge volatility in raw material prices, the company isn’t able to pass on the same instantly to its customers and thereby the profitability can get impacted in the shorter term.

- What is leading to high growth and high profits for Prima in Cameroon. Why is new competition not coming up?

- Need to Watch out on expansion of African JV and Latin America MU set up and its production capacity.

- No hedging strategy in place for now.

Disclaimer: As of this writing, Prima Plastics(BSE: 530589 ,CMP:122) forms a small portion of my Portfolio and you might want to take this analysis with a pinch of salt. This is not a recommendation to buy, sell, or hold. I am not a SEBI registered analyst.I wrote this document to organize my thoughts and deepen my understanding about the company. If you are looking for hot stocks, quick tips, multibagger ideas, this is not the right place for you.

Please share your feedback and if you have any negatives views on the company , this would help me assess the buisness in a more stringent way going forward.Thanks.

Hi Gaurav,

Very detailed analysis of prima plastics and the company have performed well too. Can we expect similar posts from you in the future too because after this I could not find any business analysis on your blog.

Regards,

LikeLike

Hi Sarvdeep ,

Its Gururaj , not Gaurav :).Offlate i have not written any analysis , i share write one soon. Feel free to share any idea , i will write on the same.

LikeLike

Reblogged this on Vishal Jajoo.

LikeLike