Last week I met a friend of mine who is also into investing and we got to an interesting discussion on Dividends, Short term capital gains and this discussion is the germ for this post. So Manoj if you are reading this full credit to you for bringing this topic up.

For a Moment Let’s assume that you are a Master Stock picker and have the knack of Identifying Stocks which can double every year. Crazy thought ah ? In the current Bull Run atleast some guys believe so.

Every morning most investors wake up with thought of identifying a 2,5,10 and sometimes even hundred bagger including me at times. However the time horizon in investing is something which most people ignore and patience required to hold these winners are “very very rare” especially if you watch your stock prices daily. However talk of patience and time horizon is for an another day.

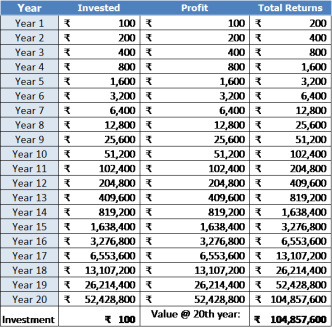

Let’s get to the point!! As I said earlier assuming you have super natural powers to pick a stock which will double every year and you can do it for 20 years straight out on one stock per year and tell me what would be your portfolio worth at the end of 20th year on a ₹ 100.00 investment ? Let’s find out.

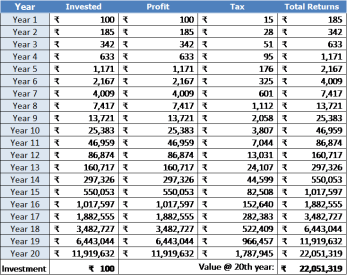

So here you will be buying a stock at the beginning of every year and you would be selling your stock before the end of the same year and buy another stock beginning of the next year. Hold on you will need to pay the government 15% tax on short term capital gains(STCG) that fall under section 111A of the Income Tax Act. Big Deal!! My aim is to multiply money and these things hardly matter if I can double my ‘one’ stock portfolio every year.

So let get back to previous question how much can you make on a ₹ 100.00 investment which doubles every year? 50,000? Or maybe 3 to 4 lakhs. No, 10.48 Crores!! WTF? Are you serious? You kidding right? Go see it yourself .

Well done!! You are a genius you have multiplied your wealth starting from ₹ 100.00 to ₹ 200.00 in the first year to 1 lakh by 10th year and 10 crores in 20 years. Oh wait did I miss something? Oh yes 15% tax on STCG.My bad I will add that your yearly returns. Big deal that’s not going to make much difference, does it? Let’s find out.

Oh no, Most of my gains are wiped out!! Yes 10.48 Cr to 2.2 cr, i.e. 8.2 Cr gone out of the window Boom!! Well if you are thinking Government has taken 81 % of your returns that is not quite right. You have paid 39 lakhs to the government in taxes and this 8.2 crores is what was expected if you had left the money remained invested in stocks without paying taxes.

Evading Taxes? Isn’t that a crime? Yes it is and I am not advocating to do that in any stretch of imagination. You could have avoided taxes by holding any security over 1 year to make it Tax Free!!

Any investment made and held for more than 1 year would fall under Long term capital gains(LTCG) which would make this investment completely Tax free. And I am not counting the dividend over this 20 year period.

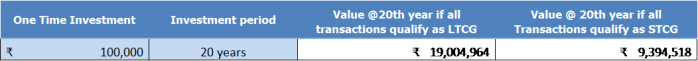

Ok but now you must be thinking getting doubling your portfolio year on year sounds far fetched so lets consider 30% returns on a yearly basis.

So on a one time investment of 1 lakh with a investment period of 20 years your portfolio would be 1.9 cr with a 30% return if we consider all the transaction for LTCG. However if you have paid for each transaction 15% tax year on year with a holding period of less than a year then you would end up with 93.94 lakhs.Your notional loss would be 96 lakhs even though you would paid 16 lakhs as taxes. And this 16 lakhs would be have earned 80 lakhs over the 20 year period.

These Taxes and brokerages might look small on a 6 months to 3 year basis however it matters a lot in the long run . So if you are in stock markets to make wealth and not monthly or annual income place bets over a longer term to avoid taxes and brokerage.

Oh wait, What about Brokerage, STT, Service charge, Stamp duty, Swach Bharat Cess, Krishi Kaylan Cess? Well that’s a topic for another day!

Note of Caution: We are observing a Bull Run in the markets and like everyone in the markets I am optimistic about India’s potential and demographics however above quoted example could be disastrous to your wealth if you believe this is going to be true or possible as we are not only expecting the stock to double and also assuming you hold 1 stock in your portfolio.

If you are lucky to have done this in the recent past and expecting your returns at the same rate for 10 or 20 years would be highly Irrational .Stocks unlike your Fixed deposit never move in a linear fashion , your fixed deposit on 7% interest will earn 0.019% day after day irrespective of market sentiments,Global uncertainity,Commodity/currency volatility etc etc.

However stocks invested for longer period of time can beat your FD even though they move in non linear fashion, sometimes highly volatile with low to medium risk .

To conclude let me reiterate what bill gates once said which is apt for current scenario in the markets “Success is a lousy teacher. It seduces smart people into thinking they can’t lose”.